Written on: July 1, 2021 by Patrick Heskins

They say every cloud has a silver lining: the 2020 thunderstorm bestowed a little of this on the aerosol industry, as The British Aerosol Manufacturers’ Association’s (BAMA) annual filling survey demonstrated the strength and versatility of this sector, despite the challenges of the COVID-19 pandemic.

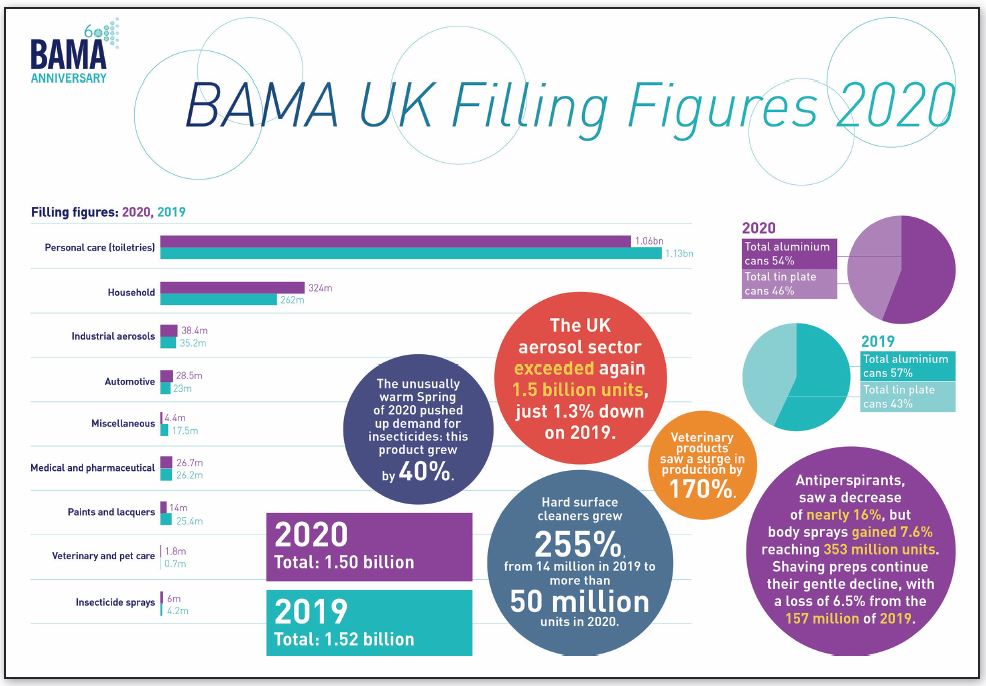

National lockdowns and closure of non-essential activities impacted everyone. The aerosol sector was quick to adjust to the changing circumstances and respond to new market needs, with overall production still in excess of 1.5 billion units, down just 1.3% from 2019.

There have been variations by product category. Hard surface cleaners grew 255%, from 14 million in 2019 to exceeding 50 million units in 2020, while Household product filling saw a general increase, with the exception of shoe polish. Veterinary products also saw a surge in production by 170%. Both of these shifts seem to come as direct consequence of the pandemic, with homes and public places looking to improve hygiene standards, and restrictions on social interaction leading to a peak in pet adoptions and pet care.

The unusually warm Spring of 2020 pushed up demand for insecticides; working from home meant that the presence of insects was more noticeable and possibly more annoying. This product’s fillings grew by 40%.

Unsurprisingly, with few opportunities to go out-of-doors, hair spray sales were down by nearly 5% and other personal care/cosmetic products, such as suntan and bronzing sprays, declined by two-thirds. There was an even bigger reduction for novelty products, including party strings and glitter sprays, which reduced to one quarter of the previous year’s output.

The stalwart of UK aerosol production for many years has been antiperspirants; these saw a decrease of nearly 16% in 2020. Body sprays partially compensated by gaining 7.6% and reaching a total output of 353 million units. Sales of shaving preparations continue to show a gentle decline, with a loss of 6.5% from the 157 million of 2019.

Sales in other aerosol categories kept fairly stable. BAMA figures show some ups and down across the years in different sectors; this is often affected by the data received and where the product filling has been distributed by those contributing.

Export volume from UK aerosol manufacturers continues to be very strong, both to the EU and around the world. BAMA looks forward to seeing this continuous growth in the coming years, following new trade deals by the UK government.

“I was relieved to see that the overall UK aerosol production held up remarkably well, despite most of us spending 2020 in lockdown,” observed Patrick Heskins, BAMA Chief Executive. He continued: “The figures BAMA put together showed only a minimal drop compared to 2019, with some sectors, such as disinfectant sprays and hard surface cleaners, seeing significant growth.

None of us should underestimate the importance that these products played during the pandemic and the response of our industry, across the supply chain, deserves praise for a job well done.

For the first time since we started our Annual Filling Survey, member companies were asked to provide some detail on their UK sales versus export. The figures kindly provided show the importance of the UK aerosol industry as an exporter—29% of the aerosols filled are sold to the internal market, 55% exported to EU countries and 16% to the rest of the world.

This means UK aerosol manufacturers meet about 65% of UK demand and produce 17% of all aerosols sold in the EU. We are still the largest manufacturer in Europe and the importance of the EU as a market must be reflected in our ongoing strategy. However, as the UK Government signs new trade deals around the world, we should look at making the best of the opportunities offered by new opening markets.” SPRAY